TCSA worked with several organizations to create this to help your organization make decisions based on changes in the bill. However, some parts of House Bill 3 affecting charters called for the Commissioner to make implementation rules. All charter leaders should continue to check for rule updates from the Texas Education Agency (TEA).

An over-arching summary of House Bill 3 is available at www.thetexasplan.com or here. For updates on TEA guidance related to House Bill 3, please visit https://tea.texas.gov/hb3/. For House Bill 3 questions specific to your individual charter district, please email TEA at HB3info@tea.texas.gov.

House Bill 3: Changes and Implications for Public Charter Districts

Changes to the Funding Formula and Other Funding Streams

- Charters and ISDs both receive a basic allotment of $6,160 per ADA.

- Charters are not entitled to the following:

- Sparsity Adjustment - to address issues with economies of scale in ISDs with sparse student populations

- Fast Growth Allotment - additional .04 weight per ADA for ISDs in which the growth in student enrollment over preceding 3 years is in the top quartile of student enrollment growth for that period statewide

- Tier Two Allotment

- Charters have access to the “Formula Transition Grant,” which compensates for decreases in M&O funding from 2018-2019 onward for four years.

- Charters are entitled to the following:

- Small and Midsize Allotment.

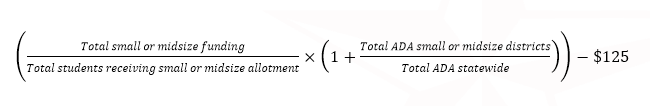

- All charters will receive this allotment. TEA will use the following formula to calculate the allotment per student in ADA:

- College, Career, and Military Readiness Outcomes Bonus

- Bonus for each graduate deemed to be “college, career, or military ready” above the 25th percentile of districts statewide in the ‘16-17 SY, as measured by proficiency and college enrollment, career certification, or military enlistment. The 25th percentile threshold will remain static. The ‘16-17 25th percentile rate is unknown/has not yet been calculated; most recent statewide average (‘16-17) is 54.2% of students meeting college, career, or military readiness proficiency standards (does not include college enrollment).

- Amounts:

- $5,000 for eco. dis. graduates

- $3,000 for non-eco. dis. graduates

- $2,000 if graduate is enrolled in a special education program under Subchapter A, Chapter 29

- Teacher Incentive Allotment (outlined below)

- Transportation Allotment

- Changed from linear density model to simple $1/mile reimbursement

- New Instructional Facility Allotment

- Cap is increased from $25 million to $100 million

- Dropout Recovery and Residential Treatment Center (RTC) Allotment

- $275 per ADA for each student residing in an RTC or who attends a district or district campus designated as a dropout recovery school under Section 39.0458

- Reimbursement for Optional College Preparation Assessments

- 1 exam per student per academic year in 8th (preliminary college preparation assessment), 10th (preliminary college preparation assessment), and either 11th or 12th (college preparation assessment)

- Assessment must be valid, reliable, nationally norm-referenced and used by colleges and universities as part of admissions process; OR the assessment instrument selected by the Texas Higher Education Coordinating Board under Sec. 51.334

- Certification Examination Reimbursement

- Districts are reimbursed for the cost of the certification exam for students enrolled in career/tech program, under Sec. 29.190(a) as provided by Sec. 29.190(c)

- Incentive for Additional Instructional Days

- 30 instructional days paid at half-day ADA

- Requirement for those minutes and when during the school-year (summer is likely) the instructional days can be offered will be determined by TEA rule-making

- Special Education Allotment

- Increases the weight applied to the mainstream instructional arrangement of the special education allotment from 1.1 to 1.15.

- Dyslexia Allotment

- Compensatory Education Allotment

- Weights are increased and range from .225 to .275

- Funding will be determined by severity of disadvantage based on a five-tier spectrum of poverty determined by census blocks (based on student address). Census blocks are typically smaller (between 600 and 3,000 people, typically) than zip codes and may cut across zip codes.

- Commissioner creating advisory committee to help determine tiers.

- Charters must assign students to census block group using TEA resources to determine the severity of economic disadvantage.

- Compensatory education funding can be used as it always was, but it can also now be used to provide child care services for the children of students at risk of dropping out and for life skills programs.

- Bilingual Education Allotment

- Retains existing Bilingual Allotment and provides an additional 0.05 weight to students in a dual language immersion (one-way or two-way) program model. Intended to incentivize dual language.

- Any bilingual education funds the Commissioner determines were misused will be deducted from a school/district’s foundation school program funding for the following year.

- Career and Technology Education Allotment

- Expands eligibility to grades 7 and 8

- Early Education Allotment

- Additional .1 weight for each comp. ed. student in Gr. K-3

- Additional .1 weight for each ELL student in Gr. K-3

- (Therefore, .2 weight for each student who is both ELL and comp. ed.)

- Must be used to improve literacy and mathematics outcomes for students in grades Pre-K 3 -- this allotment is intended to be enough to cover the cost of the new full-day pre-k 4 requirement

- Blended Learning Grant Program

- $6M state allocation. Amount per grant is TBD based on number of quality applicants. Agency assumes $250k average grant to 24 districts.

- Grant is for pilot program that starts with at least all teachers in a grade level on one campus using blended learning for all students; to be scaled up across campus(es) in subsequent years. Additional program requirements will be released by TEA.

- Mentor Program Allotment (outlined below)

Educator Pay and Other Regulations

- Charters may create a “Local Optional Teacher Designation System,” rating teachers as Master, Exemplary or Recognized. The rating is based on appraisals and lasts for up to five years. Districts are not required to use student achievement data (standardized test data), but can use that data in determining teacher ratings.

- The Commissioner is currently validity standards for these designation systems and evaluate them.

- Commissioner is creating Advisory Committee to assist with implementation.

- Schools must have a teacher designation system to access the Teacher Incentive Bonus, and it must be approved by TEA.

- TEA will have an application charters will need to fill out with a plan outlining their designation system. TEA will expect charters to have a rubric to appraise and designate their teachers as Master, Exemplary or Recognized. See the T-TESS rubric that 90% of ISDs use at https://www.teachfortexas.org/. TEA will expect something similar to the T-TESS rubric in charter applications for local designation systems.

- There is no target date yet for the release of this application.

- Charters could use existing designation system. TEA will review each charter’s designation system when they submit an application.

- TEA will judge the charter’s designation system based on how consistent teacher ratings would be compared to other designation systems in the state. TEA’s main objective is to ensure fair ratings, i.e. that the same teacher would not be rated lower in an ISD versus a charter, or vice versa.

- The “Teacher Incentive Allotment” is available to any school in Texas that adopts the teacher designation system (in HB 3).

- Bonuses have a base level of $5K (master), $3K (exemplary), and $1.5K (recognized) and increase based on level of student need (for rural schools and compensatory education).

- To determine the additional amount above the base bonus, the base is multiplied by the average point value for all students taught by that teacher, with a point value of 0 for a non-eco. dis. student and point values of .5, 1.0, 2.0, 3.0, and 4.0 (from least to most severe economic disadvantage) determined by the census block of the student’s home address

- TEA will determine economic disadvantage by census block group of students. The allotment is larger for rural campuses with a higher percentage of economically disadvantaged students.

- The bonuses are only available to state-certified teachers, and those a school has designated as master, exemplary or recognized.

- A “Mentor Teacher Allotment”

- Is available to charters that have implemented a mentoring program for teachers who have less than two years of teaching experience under Section 21.458.

- The Commissioner will create a formula for the funding, which is to be used for mentor teacher stipends.

- Schools receiving the allotment must provide mentor teachers and their mentees release time to engage in mentoring activities.

- Charters must use set aside 30% of the increase in the total state aid per student they get in 2019-2020, compared to the total state aid per student they received in 2018-2019. 75% of this 30% must be used to increase compensation to teachers, full-time librarians, full-time counselors and full-time nurses. Charters must differentiate these pay increases for teachers with more than 5 years of experience. TEA recently released guidance on this requirement, which can be found here: https://tea.texas.gov/hb3/. Charters must make 6.8% contributions to TRS on every dollar of salary above the state statutory minimum for every full-time teacher, counselor, librarian and nurse. The state minimum salary schedule has been adjusted and can be found here: https://tea.texas.gov/hb3/

- Charters are now subject to Chapter 554 of the Government Code, the “Whistleblower Act,” which provides protections to employees for reporting violations of the law.

- If charters fail to discharge or hire employees prohibited under 12.0271, they will be in violation of their charter. Charters must confirm that their employees are not on a do-not-hire registry under Section 22.0832.

- Charter principals must report educator misconduct to their superintendents, and superintendents must notify the Commissioner of this misconduct. This conduct includes the following: child abuse as defined in Section 261.101 of the Family Code; romantic relationships with, or solicitation of or engagement in sexual contact with a student or minor; or any other unlawful act with a child. However, educators are entitled to a hearing related to alleged misconduct to determine whether the misconduct actually occurred.

Academic Regulations/Requirements

- Charters must create Early Childhood Literacy and Mathematics Proficiency Plans & College, Career and Military Readiness Plans.

- The board of trustees of each school district shall adopt and post on the district’s Internet website early childhood literacy and mathematics proficiency plans that set specific annual quantifiable goals for performance in reading and mathematics at each campus.

- The plans must also outline any professional development targeted to help teachers meet their proficiency goals.

- Charters must administer a kindergarten reading instrument and a 1st-2nd grade reading instrument from a list approved by the Commissioner or by a district-level committee. They must administer the instrument according to the Commissioner’s recommendations. Student performance must be reported to the student’s parent/guardian within 60 calendar days; and annually to the Commissioner. At least one instrument per grade level (PK, K, 1, 2) will be made available at no cost to district. This section subject to rule-making by the Commissioner.

- Charters must use a direct instruction and phonics curriculum for grades kindergarten through 3. This section subject to rule-making by the Commissioner.

- All K-3 teachers must have attended a Teacher Literacy Achievement Academy by school year 21-22. Principals in schools with grades K-3 must also attend the Academy. These Academies have historically been run by Education Service Centers; however, there is precedent for individual LEAs applying to run their own.

- Charters must prioritize placement of highly effective teachers in grades K-2. Charters must administer reading development and comprehension instruments for Kindergarten through the 3rd

- Charter high school students must complete a FAFSA application as a part of their graduation requirements, unless their parent/guardian signs a form declining it.

- Charters will have access to tools to help them implement bilingual and special language programs.

Pre-K

- If a charter district offers Pre-K, then Pre-k for eligible 4-year-olds must be full-day by SY 2021-22. Pre-k for 3-year-olds can remain half-day. The number of minutes that qualify as full-day will be determined by TEA through rulemaking.

- Pre-k funding is still half of ADA for each Pre-k student

- Additional funds to cover costs of mandate for full-day are expected to come from the Early Learning allotment

- Districts that do not currently offer Pre-K do not have to start offering Pre-K; districts that already offer Pre-K do not have to continue offering it.

- Pre-k for 4-year-olds must comply with high-quality program standards from TEA: https://tea.texas.gov/Academics/Early_Childhood_Education/High-Quality_Prekindergarten_Program/

- Requirements include: use curriculum meeting TEA’s Pre-k guidelines; measure student progress and learning outcomes; aim for 1:11 student to teacher ratio; not use any Common Core material or standards; have teachers that are certified and have at least 1 of 5 other possible credentials listed under 29.167 of Texas Education Code

- Charters must test Pre-k students with an assessment instrument approved by TEA. Charters will also need to report specific information on Pre-k programs to TEA.

- Charters are entitled to an exemption from any part of the new Pre-k law if the charter applies for the waiver and (a) the charter would be required to construction classroom space to meet the requirements, or (b) implementation would result in “fewer eligible children being enrolled.” Charters must first conduct a public meeting and consider partnerships with public and private entities to offer Pre-k before requesting a waiver. Waivers cannot exceed 3 school years, subject to one renewal (max = 6 years)

- Charters cannot simply issue bonds to fund new Pre-k facilities. They first have to consider partnering with other public and private entities (listed in statute are providers eligible).

Other Non-HB 3 Bills with Impacts on Charters

- Senate Bill 2293 creates a common charter school admission application form. TEA will create the form online. Families will need to fill out applications for charter schools using this form. SB 2293 also requires the charter holders to submit waitlist data to TEA, not later than the last Friday in October of each school year. Charters must submit data on the following: 1) the number of students enrolled; 2) the enrollment capacity; 3) the total number of students on the waiting list; 4) the number of students on the waiting list disaggregated by grade level; 5) the information described aggregated for all campuses operating under the charter holder's charter; and 6) any information required by the commissioner.

- House Bill 3007 requires TEA to provide each school district a copy of the source data submitted to the agency by entities other than the district that the agency considers in the district’s accreditation status or performance ratings.

- House Bill 391 requires schools to provide instructional materials to students in printed format if the student does not have reliable access to technology at home.

- House Bill 2348 prohibits employers from terminating, suspending, or otherwise discriminating against an employee who is a volunteer emergency responder and who is absent from or late to work because they are responding to a declared disaster in their capacity as a volunteer emergency responder.

- House Bill 4258 gives the attorney general sole authority to review the record of public notice and hearings relating to any bond financing an educational facility for an authorized charter school. The attorney general will also have the ability to issue approvals for the tax-exempt status of the bond issuance.